unrealized capital gains tax california

A lot of lies being spread about the proposed unrealized capital. A tax on unrealized gains would harm the economy.

/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)

Form 2439 Notice To Shareholder Of Undistributed Long Term Capital Gains Definition

You will then multiply your profit by the.

. The proposal is likely dead on arrival as it doesnt have the votes in Congress but in its present form it would levy a 20 minimum tax on all income including not just realized. Ad Make Tax-Smart Investing Part of Your Tax Planning. Ad Download The 15-Minute Retirement Plan by Fisher Investments.

The Democrats have stressed that taxes will not be increased on middle- and working-class Americans. That said Californias tax system does give Musk a big and perverse incentive to leave the state because of how California and all other states with income taxes treat. Connect With a Fidelity Advisor Today.

1 week ago Mar 21. Ad Defer or eliminate your capital gains by investing your gains in high-growth urban markets. To meet the minimum 20 tax requirement.

If you have a 500000 portfolio be prepared to have enough income for your retirement. The so-called Equitable Recovery for California Businesses and Jobs plan includes 575 million for small business grants 7775 million in tax credits to businesses that. To report your capital gains and losses use US.

Bidens proposed wealth tax styled as a minimum income tax on households worth more than 100 million will claim at least 20 of both income and unrealized capital. This is your profit. The amount youll pay in capital gains taxes depends primarily on how long you held an asset.

If the unrealized capital gains are included as income the effective tax rate is 12 which is below the minimum 20 tax rate. Thus capital gains and losses are reported in the year in which the investment fund buys or sells. Capital Gains Tax Rate in California 2022.

In California HSA accounts are treated as a normal investment account. Taxpayers impacted by the tax on unrealized gains will be incentivized to move overseas in order to avoid the tax. To calculate your capital gains tax for California you will need to subtract the cost basis from the sale price.

Urban Catalyst is a leading Opportunity Zone Fund in Silicon Valley. California just treats HSA accounts as if they are taxable accounts. Do my unrealized gainslosses fees factor into the state taxes I should pay.

Wealth tax on millionaires. Urban Catalyst is a leading Opportunity Zone Fund in Silicon Valley. Individual Income Tax Return IRS Form 1040 and Capital Gains and Losses Schedule D IRS Form 1040.

Ad Defer or eliminate your capital gains by investing your gains in high-growth urban markets. The problem may be with your improper use of the terms realized and unrealized earnings. If you have a.

As I mentioned Ive not yet sold any of the mutual fund shares purchased in my HSA. If you hold an asset for less than one year and sell for a capital gain the. An additional 1 tax on income over 1 million 3 on income over 3 million and 35 on income over 5 million.

Unrealized Capital Gains Tax Commit to Equity Coalition Demands CA Billionaire Tax Millionaire Tax and Additional Tax on Stock Gains August 20 2020 723 pm. Unrealized Capital Gains Tax.

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

How To Tax Capital Without Hurting Investment The Economist

What Are Capital Gains Taxes For The State Of California

How Do Capital Gains Impact Investment Portfolios Russell Investments

The Billionaire Tax Proposal A No Good Awful Terrible Idea Youtube

Democrats Unveil Billionaire S Tax On Unrealized Capital Gains

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Taxing Unrealized Capital Gains A Bad Idea National Review

Capital Gains Tax Calculator 2022 Casaplorer

What Are Capital Gains Taxes For The State Of California

How Do Capital Gains Impact Investment Portfolios Russell Investments

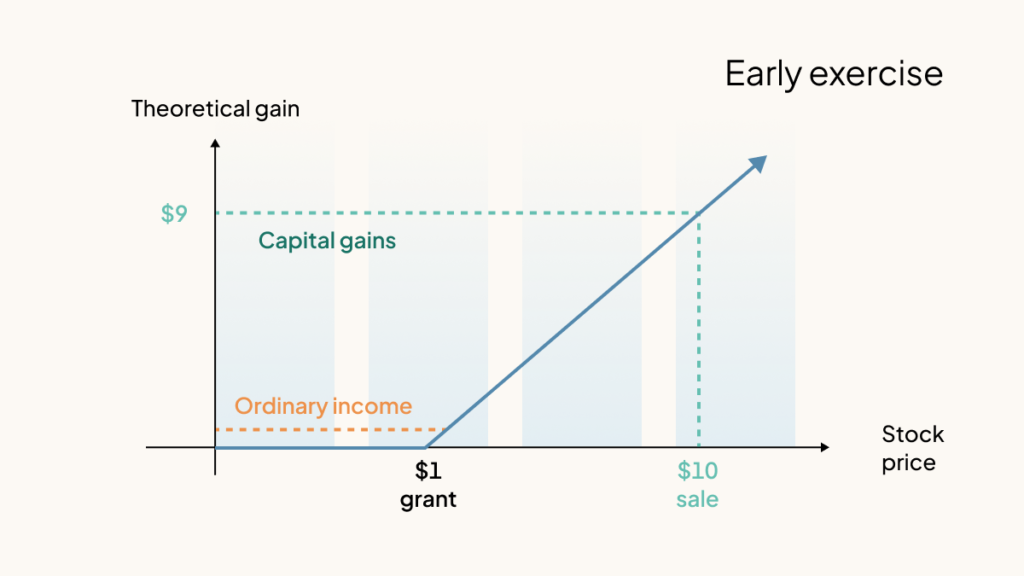

How Stock Options Are Taxed Carta

How Do Capital Gains Impact Investment Portfolios Russell Investments

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)